what is suta tax texas

2 hours agoPublicly available tax records reviewed by CNNs KFile show Walker is listed to get a homestead tax exemption in Texas in 2022 saving the Senate candidate approximately. The states SUTA wage base is 7000 per.

Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxes.

. Assume that your company receives a good assessment and. Timeline for receiving unemployment tax number. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

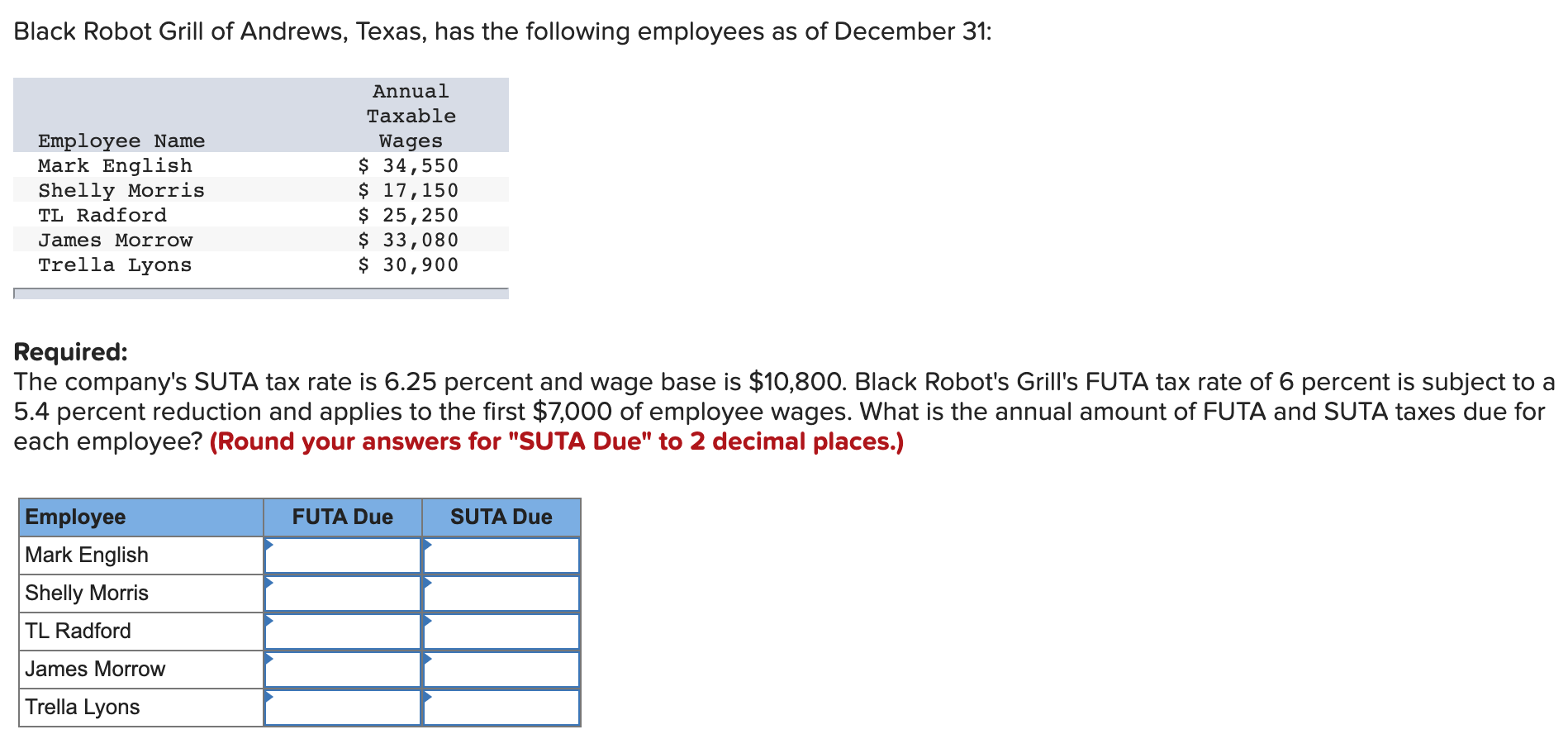

The FUTA tax rate is a flat 6 but is reduced to just. 9000 taxable wage base x 27 tax rate x number of employees Texas SUTA cost for the year. Who pays Suta in Texas.

You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax email or postal. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. SUTA was established to provide unemployment benefits to.

Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

An employers SUI rate is the sum of five components. The state typically issues a SUTA. Register immediately after employing a worker.

Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631. Heres how an employer in Texas would calculate SUTA. General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training.

The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance. The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers. The amount of the tax is based on the employees wages and the states unemployment rate.

Employer registration requirement s.

Benefits May Be Available For Spouses Dependents With Employment Affected By Covid 19 Air Education And Training Command Article Display

Solved Black Robot Grill Of Andrews Texas Has The Chegg Com

Twc Expands Skill Enhancements To Ui Claimants Vbr

Learn More About How This Texas Nonprofit Saved Half A Million Dollars On Unemployment Insurance First Nonprofit Companies

The Complete Guide To Texas Payroll Taxes 2022

Texas Workforce Commission Cuts Unemployment Benefits For Some After Claim Of Overpayment

What Are Employer Taxes And Employee Taxes Gusto

Twc Finally Issues 2021 Unemployment Tax Rates

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Free Unemployment And Payday Laws In Texas 2023

Texas Sales Tax Small Business Guide Truic

Unemployment Tax Rate Archives Vbr

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com